Get Started Today Text #MyCredit

to

(914) 350-3994

Hablamos Espanol

Are you struggling to build your business credit and achieve a good personal credit score?

Feeling stressed and overwhelmed trying to manage your personal and business credit? It's understandable, as having a low credit score can hinder your ability to secure funding and reach your financial goals.

But you're not alone. Our team at Silva Credit Advisors is here to provide you with the tools and support you need to improve your credit score and confidently navigate the world of personal and business finance.

ONE THING ABOUT Silva Credit Advisors,

We've witnessed firsthand the transformational impact that financial freedom can bring to people's lives

We understand that historically disadvantaged communities may face unique challenges when it comes to understanding, building and repairing their credit. That's why we are dedicated to providing education and support to empower individuals and businesses in these communities to take control of their financial futures.

Our team is committed to helping you overcome any obstacles and achieve your financial goals, no matter your current circumstances.

Everyone deserves to have access to the tools and resources necessary to achieve financial success, and that's why we're here to help.

WHAT WE PROVIDE AT SILVA CREDIT ADVISORS IS

Credit Freedom

At Silva Credit Advisors, we have helped numerous clients achieve financial freedom through our business credit and personal credit repair solutions.

Our proven strategies have saved our clients millions of dollars, allowing them to focus on achieving their goals.

Whether you're looking to start a business, buy a home, or simply improve your financial standing, having good credit is essential.

Our team of experts has the experience and knowledge to navigate the complexities of the credit industry and negotiate on your behalf with creditors and credit bureaus.

We keep you informed throughout the process, providing you with the transparency and support you need to make informed decisions about your credit.

Silva Credit Advisors is a safe place for your credit repair journey

We understand you may struggle with

Not having the time or resources to manage Your credit on your own

Accounts in collections or charge-offs

Late payments and missed payments on credit accounts

getting approved for loans or lines of credit

Limited credit history or a low credit score

We don't just fix credit, we help you create a path towards financial stability and success

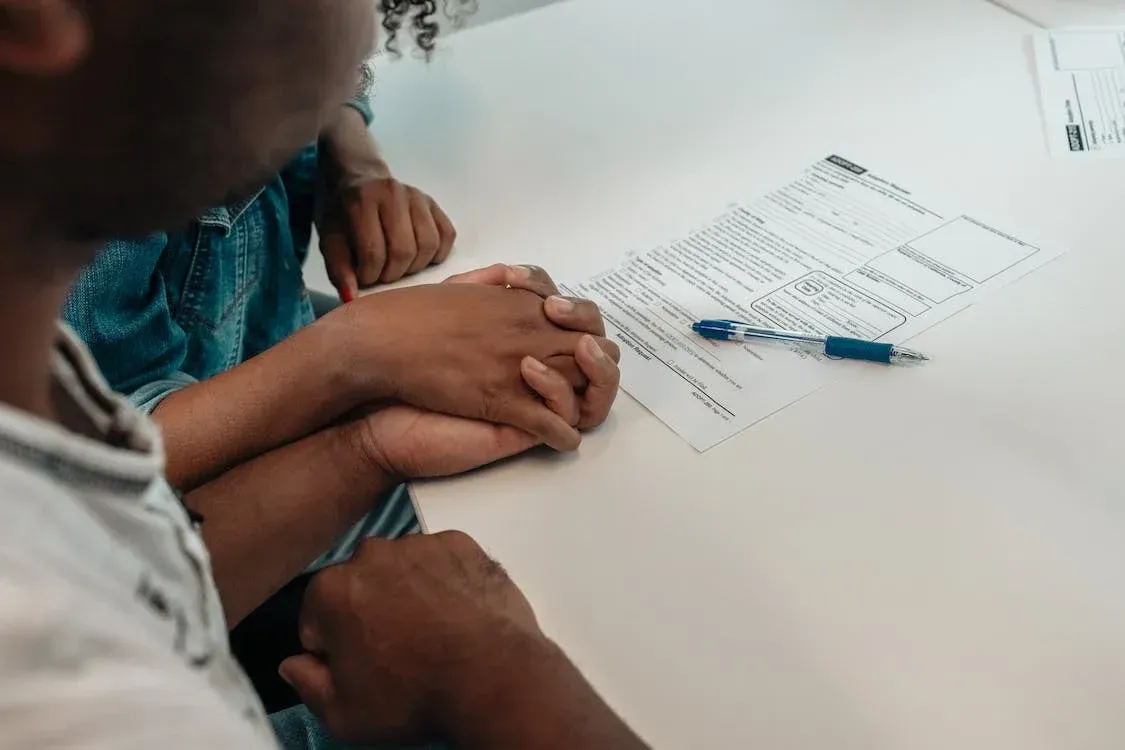

Listen, we know it can be scary to trust someone with your current credit situation. But at Silva Credit Advisors, we take your trust very seriously. Here's some of the ways we show our commitment to our clients.

Personalized Approach

We take a personalized approach to credit repair and business credit building, creating a customized plan that fits your unique needs and goals.

Transparency

We provide full transparency throughout the credit repair process, keeping you informed every step of the way and giving you the knowledge you need to make informed decisions.

Results-Driven

Our team is dedicated to delivering real results, and we won't stop working until you achieve your financial goals.

Education

We believe in empowering our clients with the knowledge and skills they need to maintain good credit and financial health in the long run..

Community

We are committed to building a community of financially savvy individuals and business owners, supporting each other in achieving financial freedom.

Innovation

We utilize innovative and cutting-edge technology to streamline the credit repair process and deliver fast and effective results for our clients

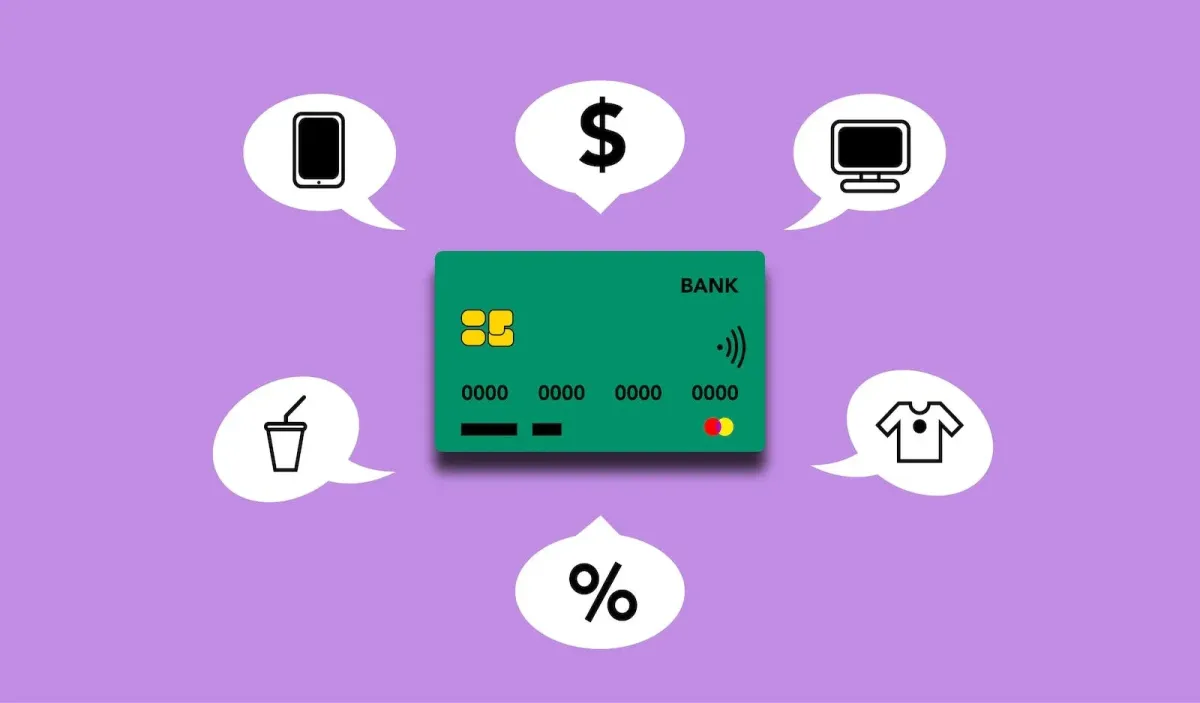

At Silva Credit Advisors, we know that you're the type of person who wants to use credit to your advantage and have complete control over your finances.

You want to make informed decisions and be able to make informed decisions on how to use credit cards, loans, and other financial tools to achieve your goals. And that's exactly the kind of person we want to work with

What Does Working With Us Look Like?

Relief from the stress and pressure of managing credit

Ability to obtain better loan terms and interest rates.

Access to financing and funding for business growth

Opportunity to achieve long-term financial goals

Your Credit Journey Partner

Hey There, I'm Aidee Silva,

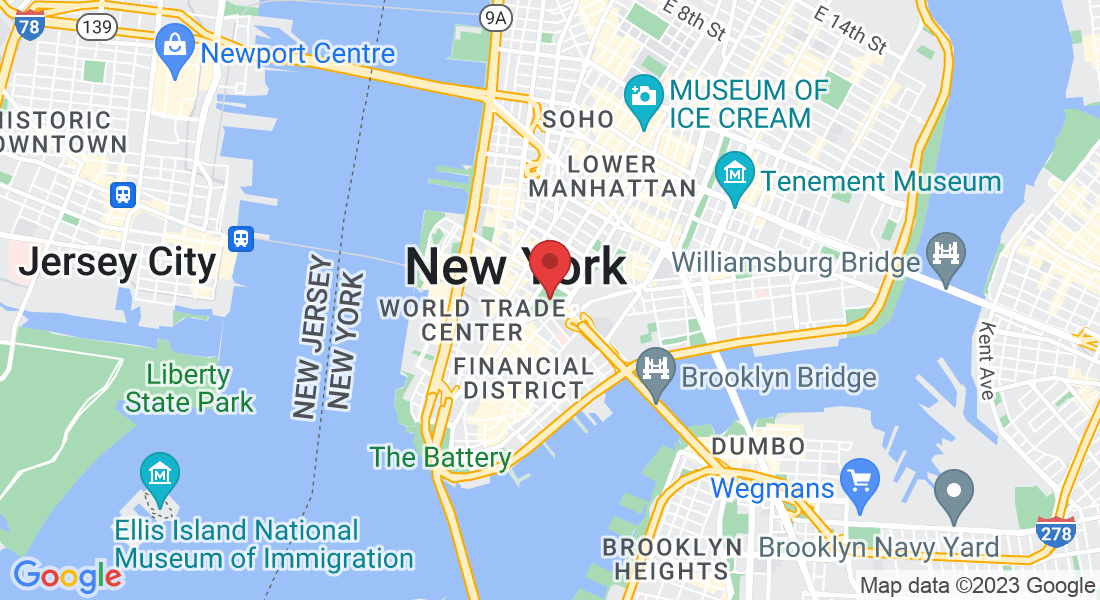

I am a driven and knowledgeable credit repair specialist and business owner. Growing up in Mount Vernon as a Mexican immigrant, I learned the value of hard work and determination early on.

These values have helped me become the successful professional I am today. With over nine years of experience, I have honed my skills in management and customer service. I take pride in overseeing my daily operations and ensuring each patient receives exceptional care.

I am passionate about helping others, particularly the immigrant community. Through my work at church and Montefiore, I help immigrants access healthcare and obtain credit cards, loans, ITIN numbers, and credit repair services.

I am invested and dedicated to helping immigrant students achieve their educational goals through the Dream Scholarship program and always strive to remain a student of life by continuously learning to help others.

My ultimate goal is to make a positive impact on the world, one person at a time. With my expertise and dedication, I am committed to helping individuals and businesses achieve financial freedom and success.

we offer a range of services tailored to meet your unique needs

Our three core services

Credit Repair

Our credit repair service is designed to help individuals and businesses with poor credit scores to improve their credit standing.

We work with you to identify and dispute any inaccurate or outdated information on your credit report, negotiate with creditors, and provide ongoing support and education to help you maintain good credit in the long term.

Business Credit

Our business credit service is designed to help business owners establish and build credit for their business.

We work with you to identify the best credit options available, help you understand the credit building process, and provide ongoing support and guidance to help you grow your business with confidence.

Document Assistance

We understand that navigating paperwork, applications, and registrations can be overwhelming and time-consuming.

Our team can assist you with filing paperwork, submitting applications, registering for services, writing letters, and more. Whether you need help obtaining an ITIN number, applying for a loan, or accessing healthcare, we're here to help simplify the process for you.

pricing for these services will depend on the specific needs and scope of each individual.

Creditworthiness isn't just about having a good credit score. It's also about responsible financial management and strategic credit building.

Here's how we work to make that a reality

We start by assessing your credit profile and identifying areas for improvement. From there, we develop personalized strategies to address any issues and build a strong credit foundation. Identifying areas where we can help.

Once we have developed a customized plan for improving your credit, we put it into action. Our team of experts will work tirelessly to remove any errors, inaccuracies, or discrepancies from your credit report and negotiate with creditors to remove any negative items.

We don't stop working once your credit has improved. We continue to monitor your credit report and provide ongoing support and guidance to ensure that you maintain your newfound credit freedom. We believe in empowering our clients with the knowledge and skills they need to maintain good credit and financial health in the long run.

What our clients are saying .

John Doe

New York, America

Working with Aidee Has been a dream

John Doe

New York, America

Working with Aidee Has been a dream

Jane Doe

New York, America

Working with Aidee Has been a dream

Frequently Asked Questions

What is credit repair, and how does it work?

Credit repair is the process of identifying and addressing errors or inaccuracies on your credit report that may be negatively affecting your credit score. A credit repair specialist will work with you to dispute any incorrect information with the credit bureaus, such as late payments or collections, and negotiate with creditors to remove any negative items..

How long does credit repair take?

The length of time it takes to repair your credit depends on the complexity of your case and the number of negative items that need to be addressed. On average, credit repair can take anywhere from three to six months, but in some cases, it may take longer.

What is business credit, and why is it important?

Business credit is similar to personal credit, but it's specifically tied to your business's financial history and creditworthiness. Establishing strong business credit can help you access better financing options, secure lower interest rates, and protect your personal credit. It can also help you build credibility with suppliers, vendors, and other business partners.

How can I establish business credit?

To establish business credit, you'll need to start by opening a business bank account and obtaining a tax identification number (TIN). From there, you can apply for a business credit card, make on-time payments, and establish a positive credit history. It's also important to monitor your business credit report regularly to ensure its accuracy.

Can credit repair improve my credit score?

Yes, credit repair can help improve your credit score by removing negative items from your credit report and establishing a positive credit history. However, it's important to note that credit repair is not a guarantee, and the amount of improvement you'll see depends on your individual circumstances. It's also important to continue practicing good credit habits, such as paying bills on time and maintaining a low credit utilization ratio.

Call - (914) 351-3939

Site: www.silvacreditadvisors.com